The weight of debt can be suffocating, and it often feels like you’re stuck in a never-ending cycle. This scenario is all too familiar for many of us, and it’s one that can keep you up at night, causing financial stress and anxiety.

Why is it so crucial to pay off debt as swiftly as possible? The answer is simple: financial freedom. In a world where money matters, eliminating debt fast can be your ticket to regaining control over your life, pursuing your dreams, and securing a brighter future.

To pay off debt fast, the journey begins with a thorough assessment of your current debt situation, understanding the types, interest rates, and total amounts you owe. Fast-tracking debt repayment involves choosing a strategy that suits your preferences, whether it's the motivational debt snowball or the efficient debt avalanche. Meanwhile, boosting your income is a key element, and platforms like Wealthy Affiliate can help bring in extra income that you can use to pay off debt. Staying committed and motivated is essential, alongside tracking tools and milestones to monitor your progress. Ultimately, the path to financial freedom starts with a commitment to change, financial discipline, and the courage to take action.

Evaluate Your Debt Situation

Before we dive into the strategies to pay off debt fast, it’s crucial to get a clear picture of your financial landscape. This begins with a thorough evaluation of your debt.

Start by gathering information about your debts. Identify the types of debts you owe, such as credit card balances, student loans, mortgages, or personal loans. Note the interest rates associated with each debt, as these can significantly impact your repayment strategy.

Calculate the total amount you owe for each type of debt. Knowing these details will help you prioritize which debts to tackle first.

This also allows you to set realistic goals, track your progress, and make informed decisions about how to allocate your resources. This knowledge is your power, and it empowers you to take control of your financial future.

Strategies to Pay Off Debt Fast

With a clear understanding of your debt, it’s time to explore the strategies that can help you pay off debt fast. We’ll cover tried-and-true methods that have been effective for many on their journey to financial freedom.

1. The Debt Snowball

The debt snowball method is a popular and effective approach for paying off debt. It involves listing your debts from the smallest balance to the largest.

You start by paying off the smallest debt first while making minimum payments on the others. Once the smallest debt is paid off, you roll the money you were allocating to it into the next smallest debt. This creates a snowball effect, allowing you to pay off larger debts progressively.

The debt snowball method is also a psychological boost. Celebrating small victories as you eliminate debts can keep you motivated throughout your journey.

2. The Debt Avalanche

The debt avalanche, on the other hand, focuses on minimizing interest costs. With this method, you prioritize paying off debts with the highest interest rates first.

By tackling high-interest debts, you reduce the overall amount you’ll pay in interest over time. It’s a financially efficient approach, though it might not provide the immediate psychological wins of the snowball method.

3. Create and Follow a Budget

Creating and sticking to a budget is an essential component of any debt repayment strategy. A well-structured budget helps you allocate your income efficiently, ensuring that you have enough money to cover your debts while still meeting your basic needs.

It can also free up extra funds for debt repayment.

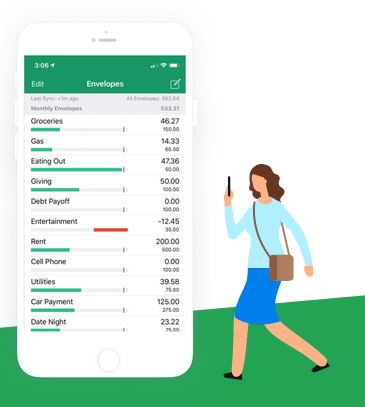

Your budget should include your monthly expenses, debt payments, and a savings cushion for emergencies. Tools and apps can make budgeting more manageable, helping you track your spending and stay on course.

- Mint: Mint is a comprehensive and free budgeting tool that allows you to track your spending, create budgets, and set financial goals. It automatically categorizes your transactions, provides insights into your financial habits, and sends alerts for upcoming bills.

- You Need A Budget (YNAB): YNAB is a budgeting app focused on the principle of “giving every dollar a job.” It encourages users to allocate every dollar in their budget, helping them control spending and prioritize debt repayment. YNAB offers both web and mobile versions.

- Wally: Wally is a simple and intuitive budgeting app that allows you to track your expenses, set savings goals, and visualize your spending patterns. It’s available for both iOS and Android.

- GoodBudget: GoodBudget follows the envelope budgeting method, where you allocate cash to different virtual “envelopes” for various spending categories. It’s great for those who prefer a visual representation of their budget.

These strategies are like the gears in the engine that will drive your debt-free journey. Whether you prefer the motivational boost of the debt snowball or the financial efficiency of the debt avalanche, choose the method that suits your needs and financial situation. Stay tuned for the next section, where we’ll explore earning extra income as a means to accelerate your debt repayment.

Earning Extra Income

While effective debt repayment strategies are essential, one key element that can supercharge your journey to paying off debt fast is increasing your income. It’s like putting your financial engine into high gear, allowing you to reach your destination even quicker.

Earning extra income can make a significant difference in your ability to pay off debt faster. Whether it’s a side hustle, freelance work, or an online business, increasing your income opens up new opportunities to achieve your financial goals.

Introducing Wealthy Affiliate as a Potential Income Source:

One excellent option for earning extra income is Wealthy Affiliate. It’s a platform that offers comprehensive training and resources for affiliate marketing, an avenue where you can promote products or services and earn commissions for successful sales. The potential here is incredible, and with the right guidance, you can turn your affiliate marketing efforts into a thriving online business.

Learn More About WEALTHY AFFILIATE Here

Success Stories and Benefits of Wealthy Affiliate:

Many individuals have found success with Wealthy Affiliate, transforming their financial situations. The platform provides step-by-step training, website building tools, and a supportive community of affiliate marketers.

It’s a fantastic option, especially if you’re passionate about affiliate marketing or interested in exploring this field.

With Wealthy Affiliate, you can learn how to create, manage, and monetize websites, ultimately generating income through affiliate marketing. Many people have achieved financial independence and turned their side hustle into a full-time career.

By integrating Wealthy Affiliate into your debt reduction strategy, you can create an additional stream of income, which can then be directed toward paying off your debts faster. It’s an exciting prospect that can help you regain control of your financial future.

Stay Committed and Monitor Progress

In your journey to pay off debt fast, the crucial part is staying the course and ensuring you reach your goal. Here’s a few tips on how to maintain your momentum:

Discipline is the cornerstone of successful debt repayment. It’s about making a commitment to follow your repayment plan rigorously.

Consistency is equally vital; it ensures you’re making regular, on-time payments. It may not always be easy, but staying disciplined and consistent will pay off in the end.

Paying off debt can be a marathon, not a sprint. To stay motivated throughout your journey, celebrate small victories, like paying off a credit card or reaching a milestone.

Find a support system, whether it’s friends, family, or an online community, to keep you accountable and encouraged. Remember why you started this journey in the first place, whether it’s to achieve financial freedom, pursue your dreams, or reduce stress.

Final Thoughts

Now, it’s your turn to take action and embark on your debt-free journey. The path might have its challenges, but the rewards are well worth it. Imagine a life without the burden of debt, where you have the freedom to chase your dreams and secure a brighter future.

As you put together your strategy to tackle debt, I invite you to explore Wealthy Affiliate. It’s an opportunity to build an additional income stream that can expedite your debt repayment.

Take the first step, and who knows where your financial journey might lead you? Join Now!