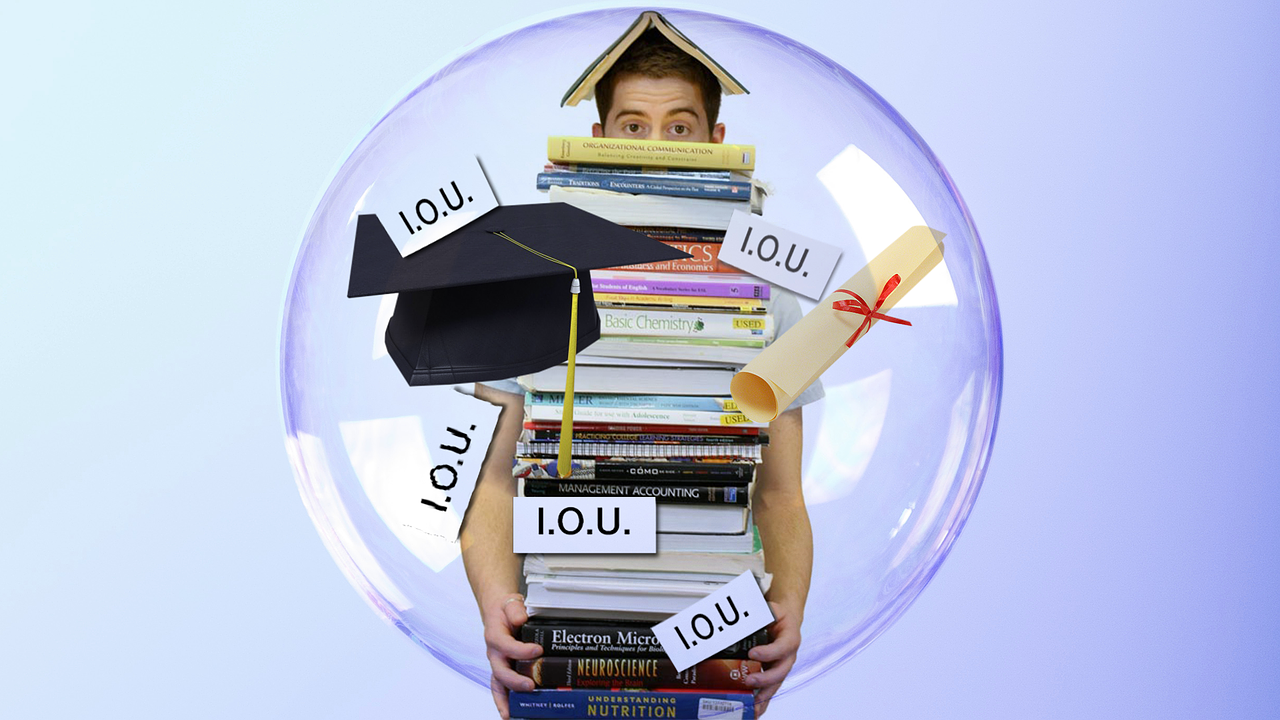

College can be extremely expensive and often times students need a little help paying for it. Student loans are sometimes unavoidable, but you shouldn’t have to be a slave to student loan debt for the rest of your life. After all, you got a college education in order to better your life, right?

If you are wondering how to pay for student loans, the following are just a few simple ways that might just help you pay them off faster.

Ask Your Employer to Pay Off Student Loans

This may seem like a far-fetched idea, but many people do ask for assistance from their employers when it comes to paying for their education. Not all companies/employers can do this of course, but larger companies are often more than willing to negotiate a student loan payoff.

If you are in the interview process with a potential employer, you might want to bring it up and negotiate a lower starting salary in exchange for a loan pay off. The company is essentially investing in you when they agree to do this.

If you have been with the company for a while, you might consider asking them for assistance paying off your loans. Explain that you have been a loyal employee for X amount of years and you wish to continue moving forward in your career. The best time to bring this up would be at your annual review.

Have Your Payment Auto-Deducted

There are two reasons this is a good way to pay off your student loans. The first one is obvious… it insures that you actually make payments every month because it is automatic. You don’t have to think about it and after a while, you get used to working with the remaining balance in your bank account. This makes it easier to not accidentally spend your money before you’ve made your loan payment. Try to figure out the highest amount you can put towards the loan (the higher the better) and make that an automatic payment. Your loan will start to vanish that much quicker.

Another reason that Automatic Payments are a good idea is because many lenders (and all government lenders) will offer a lower interest rate for those who make their payments this way. A lower interest rate could cut years off of your time in debt.

Apply Your Tax Refund to Your Loan

Everyone loves getting a refund from the IRS when tax time comes around and most young people straight out of college end up getting a refund. Instead of going on a spending spree or buying the latest video game console, consider putting that refund money towards your Student Loan. After all, a refund is actually just money you overpaid to the government, so it was yours all along and if it was in your possession throughout the year you would be making larger payments to your loan.

You can also implement this strategy when you get any type of “bonus” at work or fall into a sum of money (maybe you play the lottery). While getting a bonus at work is always great, paying off that student loan faster will be better in the long run. My suggestion is that you take a small percentage of the bonus and treat yourself (a date night or a new outfit), but put the rest immediately towards your student loan.

Create Passive Residual Income

This last strategy is actually a great one that can set you up for a more lucrative future even after you pay off your student loan. Passive income is great because money continues to roll in after the initial work has been done.

Check out my article for more information on Passive Income

The concept of passive income is relatively simple. Think of it as a vending machine vs a fast food place. A fast food restaurant can only make money during the hours in which it is open and operating. With a vending machine no one needs to be present for it to make a profit. The “work” (inventory is stocked in this case) has already been done earlier allowing income to roll in even at midnight when the owner is asleep.

One of the easiest ways to create passive income is to build a website and monetize it. Once you have a website up and running, you will have to create content in order to get visitors to your site. Here’s where it becomes “passive”… visitors may come to your site at any time, not just when you are “working on the site.”

One of the easiest ways to create passive income is to build a website and monetize it. Once you have a website up and running, you will have to create content in order to get visitors to your site. Here’s where it becomes “passive”… visitors may come to your site at any time, not just when you are “working on the site.”

While building a website and making money with it may seem impossible, it doesn’t have to be. Check out my Number 1 Recommendation for learning exactly how to do this. It’s a step-by-step course program (much like college classes) that won’t leave you in a pool of debt. Cool, huh?

I loved reading your post! I am definitely a student littered with student debt and it is killing me! I will definitely be using your guide and also passing it along to anyone I know experiencing the same problem. I think what you’re doing on your website is fantastic and keep up the good work. I have book marked your site and will definitely be checking back periodically for more articles.

Thanks,

Shawn

Thanks for the kind words about my article and website. I’m glad you found the info useful and I certainly hope you can reduce your student debt quickly and start living life free from those financial chains. Good luck!

Elizabeth

I loved your article, it was very insightful and a very interesting read, I’m definitely going to share this on my Facebook page

Student loans are a huge issue for some of my friends I was reading your article and many others on ways to overcome student debt but yours is by far the most interesting

I’m definitely going to make sure to send my friends over to this article

Thanks again

-Finn

Hi Finn,

You are right, student debt affects so many people and helping others find financial freedom is one of my passions. I know what it’s like to be stuck in a never-ending cycle of owing other people money. Luckily I’ve found a way to climb out of that pit and I’ve never been happier. Thanks for sharing this with your friends. I wish you and them the very best!

Elizabeth

Learning how to pay for student loans debt free should be part of the college courses kids take. After all, it’s their money that keeps these institutions running. I feel sorry for the kids today.

They are being lied to. Kids are taking courses for credits instead of taking courses for their future careers. Than they graduate with a $250,000 education and can’t get a job.

Another myth is that everybody needs a college education. There are plenty of trade schools that cost a lot less money and with job placement after you graduate. Good luck kids, get into the Technology fields. There’s a shortage.

Best of Luck

Jack

I definitely agree with you about it needing to be a required course in college. That makes total sense and maybe someday a course like that will be offered.